Homeowners Insurance in and around Lima

Lima, make sure your house has a strong foundation with coverage from State Farm.

Help cover your home

Would you like to create a personalized homeowners quote?

Welcome Home, With State Farm Insurance

It's so good to be home, especially when your home is covered by State Farm. You never have to be concerned about the unexpected with this terrific insurance.

Lima, make sure your house has a strong foundation with coverage from State Farm.

Help cover your home

Why Homeowners In Lima Choose State Farm

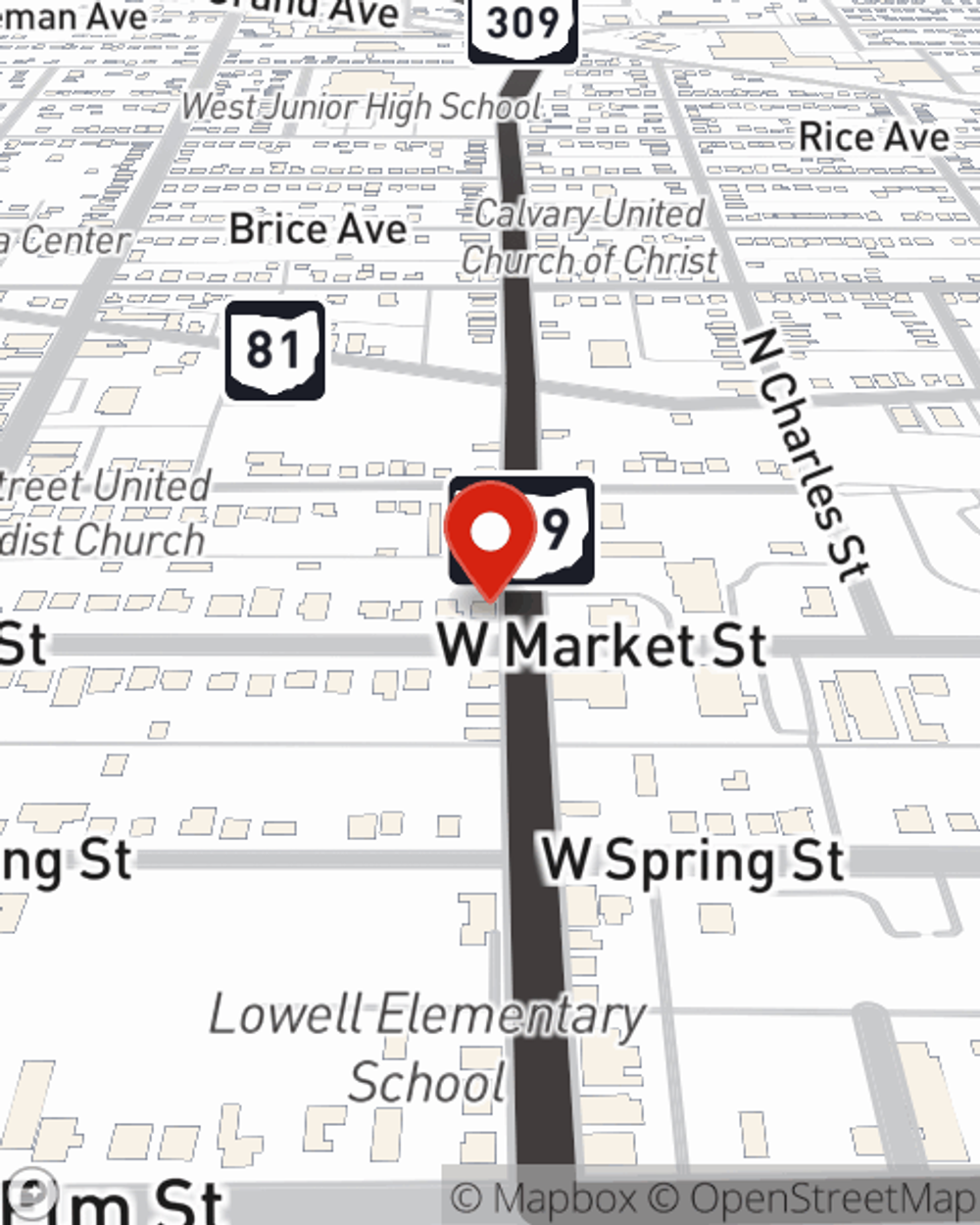

Excellent coverage like this is why Lima homeowners choose State Farm insurance. State Farm Agent Corey Frazer can offer coverage options for the level of coverage you have in mind. If troubles like service line repair, sewer backups or identity theft find you, Agent Corey Frazer can be there to help you file your claim.

Now that you're convinced that State Farm homeowners insurance is right for you, get in touch with Corey Frazer today to find out next steps!

Have More Questions About Homeowners Insurance?

Call Corey at (419) 228-3114 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

What to do during a tornado

What to do during a tornado

You see the alert. Your area is under a tornado watch, or even worse, a tornado warning. Know the differences between them, and what to do during a tornado.

Corey Frazer

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

What to do during a tornado

What to do during a tornado

You see the alert. Your area is under a tornado watch, or even worse, a tornado warning. Know the differences between them, and what to do during a tornado.